Long-Term Care

Long-term care

It’s not enough to watch the long-term care market, it’s time to take action.

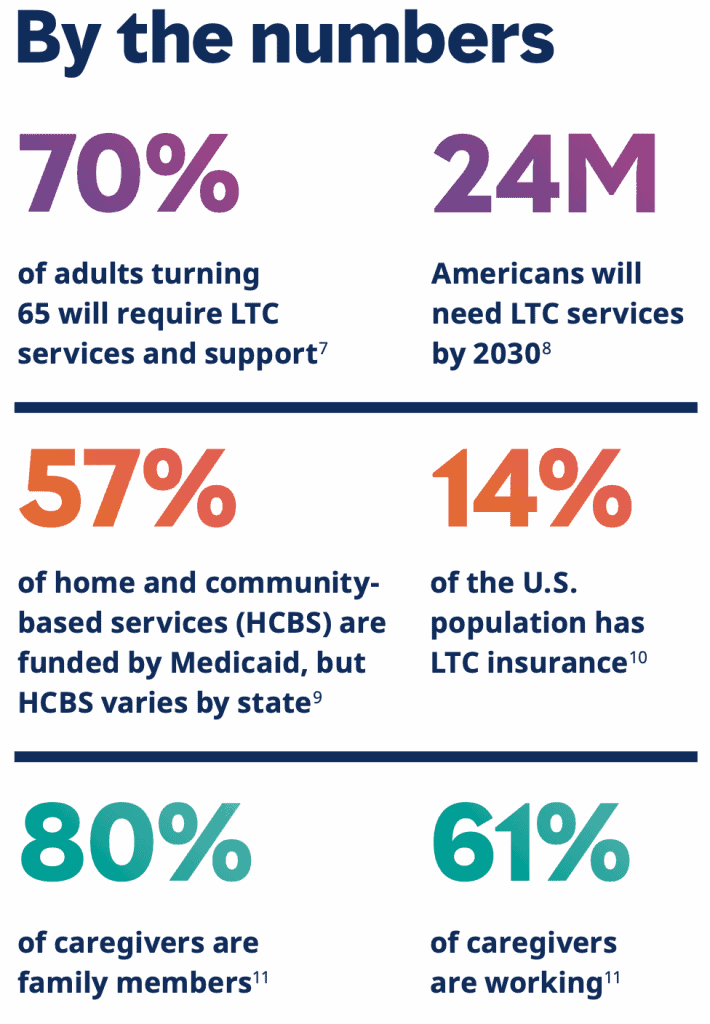

Our population is aging, states lack funding for programs, and families are under increased caregiving pressure. Washington State is leading the way with long-term care, and your state could be next.

Long-term care legislative map

Click on a state to see the latest updates.

Our interactive long-term care map will help you stay up to date with current or pending legislation in your state. Check this page often as we will be updating it as new legislation is approved.

The map is color-coded to show what action each state has taken so far. We have it broken into four groups: Implemented, filings started, considering, and not yet started.

Why the legislative

changes matter

The first to enact a law is Washington State, which is now slated to take effect July 1, 2023. The program, Long-Term Services & Supports (LTSS) is publicly funded by a 0.58% payroll tax on all wages and remuneration withheld quarterly by employers, and is mandatory for all W-2 employees. Owners of private LTC insurance were permitted to “opt-out” by applying for an exemption by November 1, 2021.

While Washington State is the first, it’s not alone. There are currently 14 states evaluating a compulsory program, including California, New York, and Pennsylvania which are expected to be passed and announced in 2024-2025. It’s worth noting that both California and New York are suggesting that the possibility of opt-out will only be permitted for those who are already enrolled in a private LTC Plan prior to the passage of state legislation.

Public awareness is at an all-time high, and as employees turn to their employers for an affordable and flexible solution, many organizations are actively reviewing the marketplace for something with real value.

Read our latest long-term care legislative update.

Read our latest long-term care legislative update.

Why MMA?

Our account teams comprise a premier group of consultants focused on helping employers navigate the complexity of leaves and employee benefits to develop and implement best-in-class programs. Combined with the power and breadth of Marsh McLennan, we are able to offer a suite of services that is unmatched in the marketplace.

Insights and news

The latest industry news, insights and thought leadership.