Retirement & Wealth

Retirement & Wealth

Mitigate risk. Reduce fees. Improve retirement outcomes.

Client tools

Retirement & Wealth Services

Asset management

Why choose our Retirement & Wealth Management services?

Our team of experienced, retirement plan professionals utilize our CEFEX® Certified fiduciary process, proprietary investment monitoring system, and employee communication program to help you mitigate plan sponsor risk, keep your plan compliant, enhance investment options and improve retirement outcomes for your employees.

Our services

Compliance and Regulatory Updates

In-house ERISA counsel to keep you informed and help you remain compliant

Employee Communications

Create campaigns to help get and keep your employees engaged

Fiduciary Vault

Electronically stores and safeguards plan documents and archives critical committee decisions

RFP, RFI, Benchmarking, and Negotiation

Helps with reasonable fees and proper financing strategies

Investment Analytics

Provides strong investment options

Plan Design Organization

Experienced insights to maximize plan efficiency and effectiveness

Financial Well-being Solutions

On-line tools, webinars, and videos to promote retirement readiness

Defined Benefits (DB) Plan Investment Management

Assistance with funding and de-risking DB plans

Non-Qualified Deferred Compensation and Executive Benefit Plans

Customized for your workforce

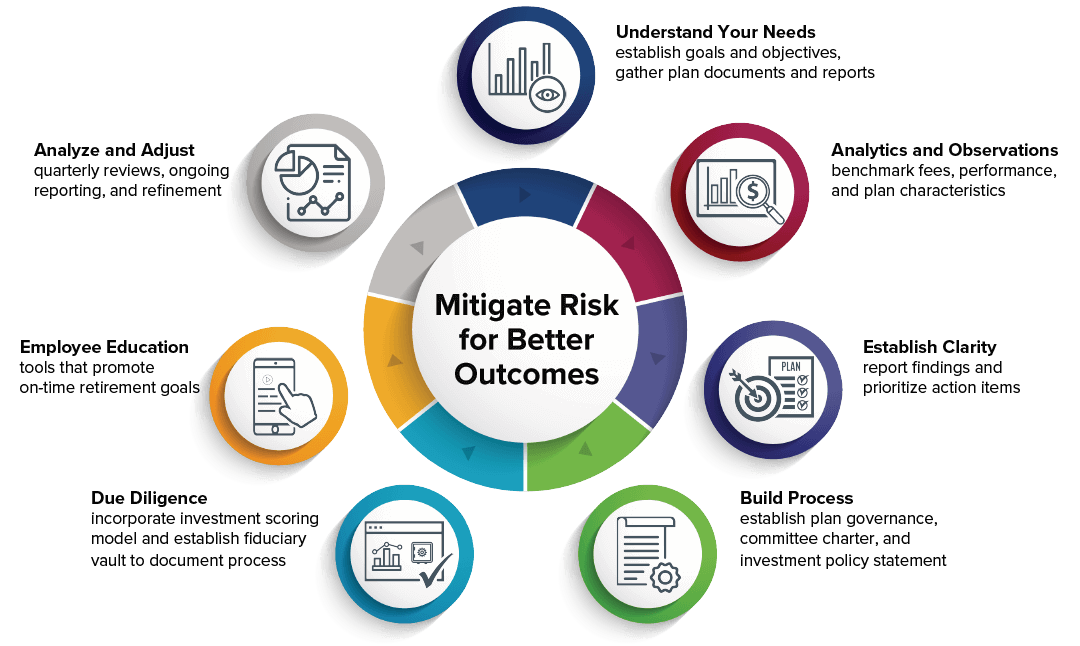

Our fiduciary process

There is only one consolidated, well-substantiated list of fiduciary best practices in the country; the Global Fiduciary Standard of Excellence. This standard has been established by The Centre for Fiduciary Excellence – CEFEX®. CEFEX® Certification is based on ISO principles and auditing methodology.

Our process has earned CEFEX® certification, ensuring adherence to the Global Fiduciary Standard of Excellence. This certification is updated through an annual review.

Financial well-being solutions

Your employees are your greatest asset when it comes to achieving your business goals, and employees who feel they are in control of their financial well-being are more likely to be productive and satisfied at work. MMA Prosper Wise℠ enables you to provide your employees with personalized financial platform and access to a team of advisors and coaches.

Insights and news

The latest industry news, insights and thought leadership.

Events

The latest events.

Click here to view our Form ADV Part 2A Brochure for Services to Employer-Sponsored Retirement Plans.

Click here to view our Form ADV Part 2A Brochure for MMA Prosper WiseSM Services.

Click here to view our Form ADV Part 2A Brochure for Personalized Advisory Services.

We are providing this information to you in our capacity as financial professionals with knowledge and experience in the insurance and securities industries, and not as legal or tax advice. The issues addressed may have legal or tax implications to you, and we recommend you speak with your legal counsel and/or tax advisor before choosing a course of action based on any of the information contained herein.

Changes to factual circumstances or to any rules or other guidance relied upon may affect the accuracy of the information provided. Marsh & McLennan Agency LLC is not obligated to provide updates on the information presented herein. This website is solely for informational purposes.

Securities and investment advisory services offered through MMA Securities LLC (MMA Securities), member FINRA / SIPC, and a federally registered investment adviser with its main office at 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Investment advisory services additionally offered through MMA Asset Management LLC, a federally registered investment adviser with its home office at Eight Tower Bridge, Suite 1200, Conshohocken, PA 19428. Phone; (610) 684-3200. Variable insurance products distributed by MMA Securities LLC, CA OK 81142. Marsh & McLennan Insurance Agency LLC, MMA Securities LLC, and MMA Asset Management LLC are affiliates owned by Marsh & McLennan Companies. Investment advisory services for MMA Prosper WiseSM are offered solely as a registered investment adviser through MMA Securities. Certain of the investment adviser representatives of both MMA Securities and MMA Asset Management LLC are additionally registered representatives of MMA Securities.

A copy of our written disclosure statement discussing our advisory services and fees is available for your review upon request. Please consult a tax professional for specific tax inquiries and recommendations. Advisory services are only offered to clients or prospective clients where MMA Securities and/or MMA Asset Management, and its representatives, are properly licensed or are exempt from licensure. Past performance is no guarantee of future returns and investing involves risk and possible loss of principal capital. No advice may be rendered unless a client agreement is in place.

d/b/a in California as Marsh & McLennan Insurance Agency LLC; CA Insurance Lic: 0H18131.

Copyright © 2023 Marsh & McLennan Agency LLC. All rights reserved.