Employee Health & Benefits

Our people deliver the expertise and capabilities to solve employers’ biggest problems.

Our approach:

Employers are facing more challenges than ever before. We work with you to navigate these challenges so you can focus on your people and your business.

A partner you can rely on:

Each of our clients is surrounded by a dedicated team with support from subject matter experts in Pharmacy, Stop Loss, Captive, Data Analytics, Clinical and Health Management, Absence Management, and Compliance. The world of work is constantly evolving, you need a partner that can help you achieve your organizational goals.

New 2024 Employee Benefits Sate of the Market

Our new report, The Evolving Workforce: 2024 Employee Benefits State of the Market, spotlights the latest benefits trends and market shifts in the middle-market workplace. We understand that predicting and responding to employee benefit trends and employee expectations can be difficult; MMA is here to help make it easier.

We offer several solutions that help our clients streamline how they offer the employee benefits while staying in compliance. Download our infographic for a free trends snapshot!

Our solutions

It’s not one size fits all, each employer has unique challenges that require custom strategies and solutions to meet your needs and your budget. Your MMA team helps you manage your plan today and prepare for what’s coming next.

Well-being Your Way

We offer solutions to help you tackle whole person health by providing turnkey communications, campaigns, evaluating points solutions or deploying comprehensive data driven strategies for your business.

ReInventRx

A trusted partner who can help you to make sense of your pharmacy program, control your spend, and deliver savings to your organization.

Stop Loss Center of Excellence

Helping you buy better with best-in-class carrier partnerships delivering better contractual terms and conditions and solutions to reduce your risk exposure.

Compliance support

Our team of house attorneys, paralegals, and compliance subject matter experts supports your organization with the everchanging world of benefits compliance including timely updates, checklists, support of 5500s, plan documents and more.

Forensic underwriting

Our team of actuaries, financial underwriters, and data analysts work together to provide reporting, budget projections, renewal negotiations and request for proposals to help plan sponsors contain costs and maximize savings.

Communications

Using benefits guides, videos, and mobile apps, our team works with you to deploy the right strategy to help educate and promote the benefits plans you offer your employees.

HR Center of Excellence

More solutions and support to help you navigate the growing number of HR priorities including compensation, workforce planning and more.

Captive Stop Loss

The RightPath Stop Loss Captive helps you capture the savings associated with self-funding while capping your overall risk.

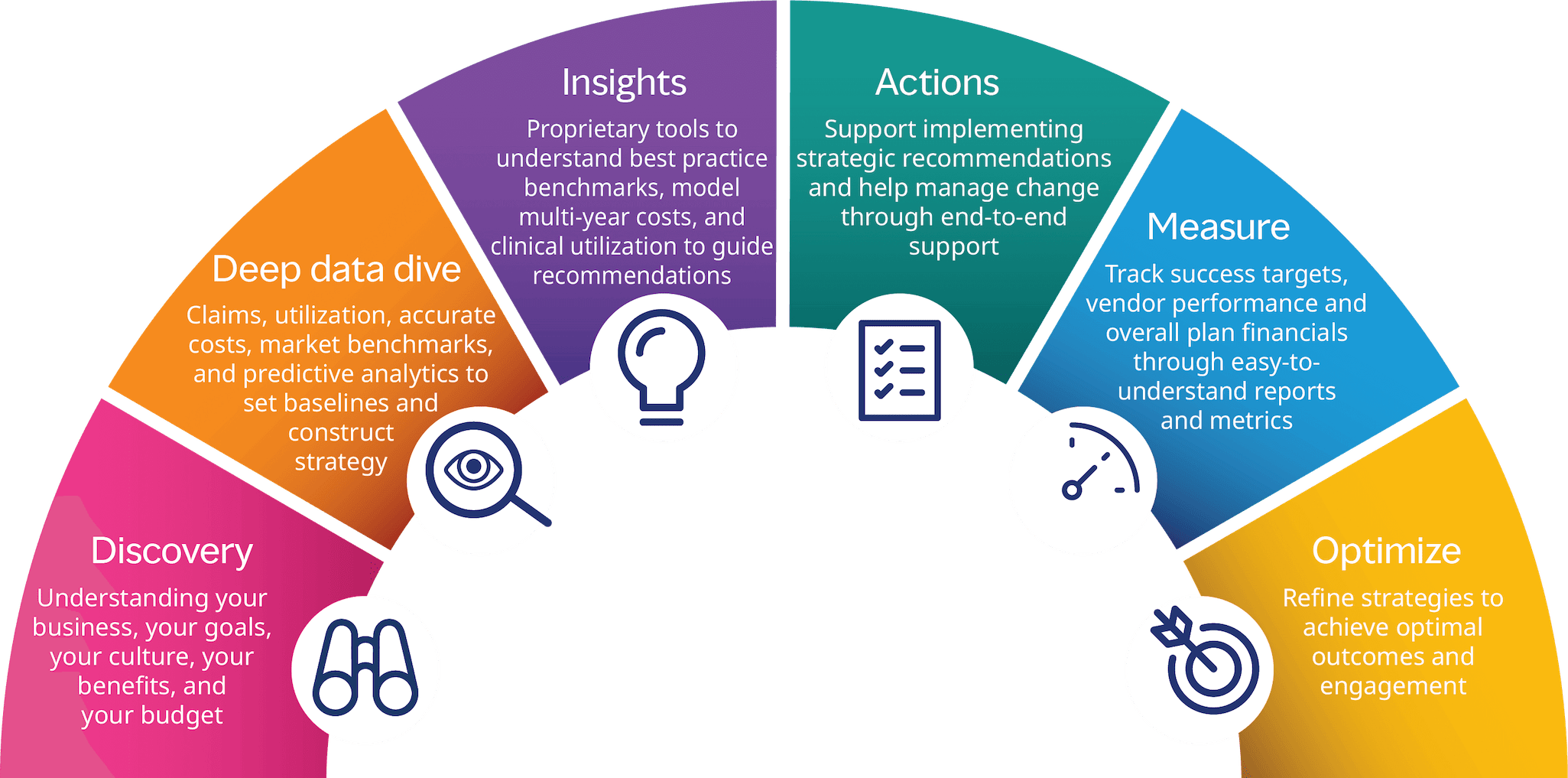

Our strategic plan process

Our commitment to our clients is unwavering. Our teams ensure that each client receives all the support and necessary resources to deliver high-quality results across all service areas by using our six-step strategic plan management process.

Reduce your employee benefits spend

Our Strategic Forecast Model interactively shows projected future plan costs in an interactive way, including the impact of increasing cost trends compared to your targeted budget to help determine if there is a gap between your budget and the projected costs. Your team can then explore ways to eliminate this gap and drive your multi-year strategy to optimize your overall benefits spend.

A complete benefits support network

Employee benefits play a crucial role in shaping a company’s culture. Designing an effective benefits plan can be a daunting task, given the multitude of options available. The challenge lies in developing a strategy that caters to the diverse needs, salaries, and goals of your workforce.

Our suite of services can help your organization strike a balance between meeting individual needs and controlling costs, especially in an ever-changing health care landscape filled with uncertainties.

Insights and news

The latest industry news, insights and thought leadership.

Events

The latest events.