Financial wellness is a vital component of employee satisfaction and productivity. It is a state of feeling secure in the ability to meet current, ongoing, and future financial obligations inside and outside of the workplace. Achieving this sense of security can be accomplished by creating attainable goals, properly budgeting, setting plans for adverse financial events, and more. By providing the right tools and resources, employees can obtain healthy relationships with their finances. That’s why Marsh McLennan Agency (MMA) offers MMA Prosper WiseSM, an employer-sponsored program that combines an award-winning online platform with experienced financial coaches and investment advisors.

Importance of financial well-being

According to the PWC Employee Financial Wellness Survey, employees are growing increasingly concerned about their financial health. The results of the survey showed that most employees are unprepared for retirement, with 53% stating they are stressed about their financial situations and 32% not saving due to debt and other expenses.1 On the other hand, 49% of those who are saving agreed to likely needing to use that money before even reaching retirement.2 The same report found that 72% of employees are attracted to companies that enhance personal financial well-being and 88% of employees use financial well-being services that their employers provide.2

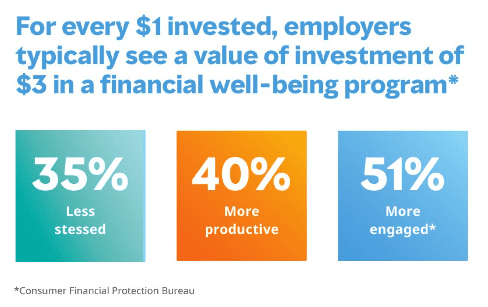

A strong financial well-being program can benefit both employers and employees. By facilitating various aspects of finance, such as budgeting, saving, investing, and retirement planning, organizations have seen a profound impact altogether. The same report states, “Employers have achieved an average ROI of $3 for every $1 invested in a financial well-being program.3” Overall, companies and employers have reported seeing lower levels of absenteeism and higher levels of employee satisfaction, productivity, and engagement. Additionally, from an employer advantage, the ability to attract and retain talent has increased as well.

The Consumer Financial Protection Bureau recently disclosed that, on average, employees enrolled in company financial well-being programs observed:

- 35% less stress

- 40% more productivity

- 51% more engagement3

A recent PYMNTS report by Enrich showed that employees also experienced a 27% increase in building up a 3–6-month emergency savings fund and a 28% increase in paying off their credit cards every month.4 Moreover, Enrich also states that employers expressed an average of 32% increase in staying on track with their financial goals.4

What is MMA Prosper WiseSM?

MMA Prosper WiseSM is an initiative that was built with financial well-being in mind. The program combines technology and the experience of licensed professionals to provide personalized financial advice tailored to individual profiles and goals. Employees have access to educational articles, videos, monthly webinars, savings tools, an Engagement Certification Program, and one-on-one coaching from MMA financial members.

The Interactive financial well-being website helps keep members on top of the latest information that is relevant to their financial needs. Topics, such as Health Savings Accounts (HSA), Health Reimbursement Arrangements (HRA), market updates, Social Security, debt management, and more are regularly updated.

The employee financial well-being engagement certification program serves to drive employee engagement and ensure employers receive a return on investment.

Employees can benefit from a large range of solutions and tools, including a financial wellness self-assessment, a money personality behavior analysis, and personalized action plans.

How financial coaching can help

One easy way to combat financial stress is to seek help from others. Our financial and investment advisors coach clients of all financial backgrounds—for every stage of life:

- Investing Basics

- Budgeting and Debt Management

- Emergency Savings

- Pre-Retirement Action Plans

- Investing

- College Planning

- Student Loan Debts

- Voluntary Benefits Strategies

- Estate Planning Basics

- Social Security and Medicare Planning

- Retirement Income Strategies

How can Marsh McLennan Agency help?

Marsh McLennan Agency provides a holistic financial well-being solution to help support your employees, increase satisfaction and productivity, and ultimately, boost your organization’s overall success. The best supplement to our website is having a financial coach who can guide you along the way in your financial journey and help you make decisions. Visit our Financial Well-being page to learn more about how MMA can help individuals make better financial decisions.

Sources:

- “Employee Financial Wellness Drops to New Low,” SHRM, accessed December 7, 2023,

- “ PwC’s 2023 Employee Financial Wellness Survey,” PwC, accessed December 7, 2023,

- “Financial wellness at work,” Consumer Finance Report, accessed December 7, 2023,

https://files.consumerfinance.gov/f/201408_cfpb_report_financial-wellness-at-work.pdf

- “Your Employee Financial Wellness Benefit Must Be Results Driven,” Enrich, accessed December 7, 2023,

https://www.enrich.org/blog/your-employee-financial-wellness-benefit-must-be-results-driven