BeneCap, offered by Marsh McLennan Agency (MMA), is a voluntary benefits captive solution aimed at enhancing an employer’s captive growth. It achieves this by seamlessly integrating 100% employee-paid lines of coverage with its current risk management strategy. The goal is to increase loss ratios to provide greater benefits to employees and potentially fund additional employee benefits.

Key motivations for reinsuring business lines

The lines of business available to be reinsured by the employer’s captive include accident, critical illness, hospital indemnity, and legal insurance. These products are governed by the Employee Retirement Income Security Act of 1974 (ERISA) and the surplus program funds received by the employer must be used to provide benefits to the employees. Identity theft can also be reinsured; however, ERISA does not govern identity theft, and there are fewer restrictions related to the use of surplus program funds.

Due to low limits, the average claim severity is low. There is no risk of catastrophic exposure. Based on carrier data, the average critical illness claim is $15,000, with a maximum possible claim of $30,000-$50,000 depending on the plan design. The average accident claim is $1,800. The maximum possible claim is typically $10,000 and would involve a severe injury, including burns or death and dismemberment. However, death and dismemberment are frequently removed from the plan design. So, typical claims do not exceed $1,200-1,800. An average hospital indemnity claim is $1,600. The maximum possible claim is approximately $12,000 depending on the plan design but such a high claim would involve a lengthy hospitalization.

Based on market and carrier data, we determined that claims frequency is highly predictable. Industry benchmarks indicate that one per 100 enrollees will incur a critical illness claim, 55 per 1,000 enrollees will incur an accident claim, and 50 per 1,000 enrollees will incur a hospital indemnity claim.

Qualification requirements for BeneCap

To qualify for BeneCap, an employer must have a minimum of 2,500 benefits-eligible employees and must offer all three supplemental health lines (accident, critical illness, and hospital indemnity). The employer must own their own captive insurance company but may engage any captive management firm.

Suppose the employer does not have their own captive. In that case, other options are available, including the use of a cell captive solution, which is a cost-effective risk financing vehicle in which assets and liabilities are segregated in “cells” of a sponsored cell captive and are utilized in the same manner as a single parent captive.

What is the value of BeneCap?

BeneCap is economically smart for our clients because it reduces risk and provides diversification, cash flow advantages, and underwriting profit to their captives. BeneCap offers enhanced management of data. We provide quarterly reporting, more transparency regarding claims and fees, and data warehousing management with real-time financial data quarterly. BeneCap achieves more control over the pricing of plans. HR can customize plans to dovetail with core medical plans. Risk is managed centrally. Employees are more satisfied when they enjoy voluntary benefits programs with lower rates and enhanced coverage. The financial results support additional benefits for the employees.

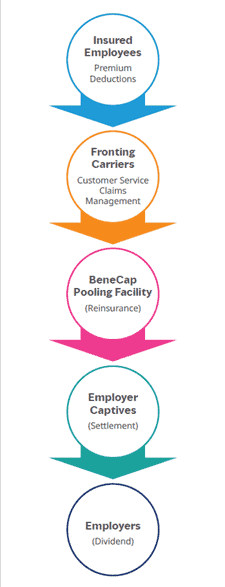

BeneCap process flow

This flowchart explains how the process works and identifies the differences between what happens today and what changes with a captive program. From an HR perspective, everything in the gray box already happens today and will remain the same. Employees enroll in technology, whether it is the employer’s technology or the carrier’s technology. The elections are transmitted to the carrier, and the deductions are transmitted to the employer’s payroll system. Deductions are taken when payroll is processed and remitted to the carrier. The carrier still adjudicates claims and processes claim payments to the insured member.

Taking the first step with BeneCap

The first step in determining the appropriate funding strategy is to conduct a 360° Diagnostic Assessment of your current benefit plans, technologies, and communications. Our comprehensive analysis combined with our experience in the benefits industry allows us to identify areas of opportunity to enhance current programs, streamline administration, reduce costs, and improve the employee experience to optimize the programs.

How can Marsh McLennan Agency help?

Whether you offer voluntary benefits today or are considering voluntary benefits for the first time, we start with discovery and needs assessment and review demographics. We conduct a plan review and benchmark analysis, which may be limited to looking at core benefit plans and seeing where they sit, and financial analysis. We will look at vendors to determine which ones make the most sense. We will provide an alternative funding overview, which is the captive option. We will look at experience and engagement, technology and enrollment, and other types of service integration, such as claims integration. We will put together the entire program for program optimization and create a report to give you a very detailed overview.

To learn more about putting your voluntary benefits to work, feel free to contact us at [email protected] or visit us at https://mmaeast.com/captive-solutions/.