As you are likely aware, the past few weeks have been a challenging environment for investors. The Coronavirus went from a few small headlines in January to the dominating force behind the recent market sell off.

The epidemic has spread rapidly beyond China and into Asia and parts of Europe and the Middle East. Above all else, financial markets despise uncertainty, and there are very few answers at the moment. Markets prefer conclusive bad news rather than total uncertainty. Hence, the dramatic market volatility. Financial markets will likely be at risk until the number of new cases outside of China reaches a peak, which is impossible to determine at this time. Asset prices tend to move to extreme levels during periods of panic, along with heightened volatility. The U.S. economy is more insulated than Asia and Europe but is not immune.

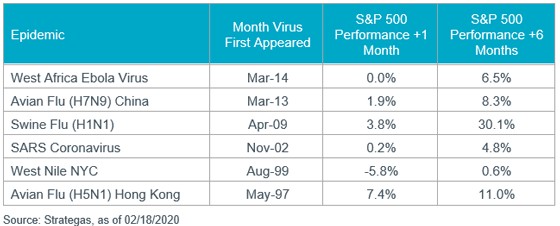

Historically, Markets have shaken off prior epidemics:

Additionally, there have only been 14 prior one-week drops of 10% or more since 1900, and the index has averaged a gain of 3.53% in the following week with positive returns 12 out of 14 times. More importantly, the average return over the next six months has been +5.86% and +12.5%, over the next year.

We caution to not let the headlines drive your long-term investment strategy. Many investors who felt they made the right decision to sell in early 2009 still sit on the sidelines or missed years of positive returns, and have made reaching their retirement goals very difficult.

Featured insights

More insights